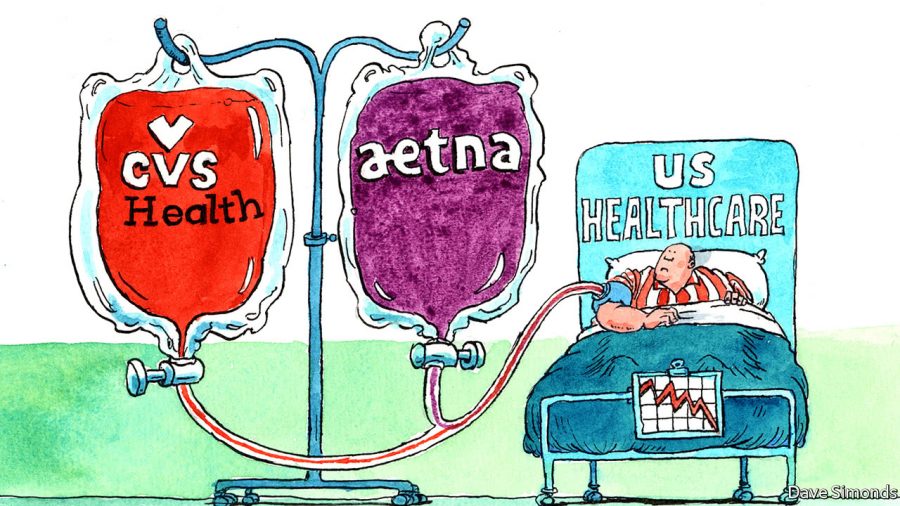

CVS Merges with Aetna

Last week, CVS announced that it has plans to buy Aetna, an American managed health care company, for about $69 billion dollars. CVS Health is a notorious drugstore chain and prescription drug insurer. Aetna sells traditional and consumer directed healthcare insurance plans related to services, such as medical, pharmaceutical, dental, behavioral health, long-term care, and disability plans. This will go down as the largest health insurance deal in history. However, there are some hesitant antitrust regulators who will have to approve the deal before it goes through, as they have been skeptical of similar healthcare mergers in the past.

Healthcare companies like CVS and Aetna are constantly searching for different ways to make medication and healthcare more affordable and accessible for their target markets. According to CNN, CVS joining forces with Aetna is an easy way to achieve this. “Buying Aetna puts CVS in a better position to compete with other integrated health care providers, such as UnitedHealthcare (UNH) and pharmacy benefits manager Optum. PBMs like Optum and CVS’s Caremark help manage prescription drug plans for commercial health insurers”.

According to Forbes, CVS’s deviation toward value-based care and population health has equated to customers taking more advantage of CVS Minute-Clinics. This means that there has been growing employment opportunities for CVS Minute Clinic nurse practitioners and drugstore pharmacists, who administer vaccines and provide advice on correct medications and dosages for a given purpose.

Yet some advocacy groups have criticized the merger. According to CNN, the Coalition to Protect Patient Choice said that “mergers like these have a dismal history,” adding that “consumers suffer by paying more and getting less choice for the vital drugs they need”.

Aetna in fact already has a deal with CVS Caremark, a branch of CVS, related to the sale of prescription drugs. Because of this existing deal, a lot of prescription drug prices will not drop from their already lowered price. Yet if CVS does eventually turn a number of their storefronts into clinics or primary care centers, customers could see cost benefits down the road.

Hospitals across America are at risk for a loss of patients because of the increase of minute-clinics. Hospitals see millions of patients in their emergency rooms and care for lots of ailments that could be directed to outpatient location care centers. According to Forbes, “All of the services CVS provides now and in the future will be to the detriment of the nation’s large hospital operators like Tenet Healthcare, HCA Holdings and Community Health Systems and the nation’s nonprofit hospital industry as well. These hospital operators are also expanding into community-based urgent care centers and even forming partnerships with retailers like CVS and Walgreens Boots Alliance. But hospitals admit they may not be moving fast enough to make their lower cost services more attractive to insurers and consumers. CVS’ $69 billion purchase of Aetna will give the pharmacy chain and its more than 1,100 retail clinics 22 million paying health plan members”.

This merger will be pivotal for the future of healthcare in the US.